As in the past, it has been the case in the case of advantages of subordinated apartment mortgage interest rates, but it seems that it is not easy to buy a house these days.It is difficult because monthly fixed spending is high, income is constant, interest rates are rising, and prices are only on the rise.And these days, housing prices seem to have risen even more as more people own houses and use them for investment purposes than those who sell them completely. I’ve been thinking about making an investment, but is that actually?I don’t have much interest in my field of expertise, and above all, I don’t have the confidence to make a successful investment through this.Rather, I think I want to prepare my own house and live a comfortable and prosperous life.

Maybe that’s why when you get married, your desire to buy and sell becomes stronger? I feel uneasy because I talk a lot these days and talk a lot in the news due to jeonse fraud. So shortly after I married my husband, I went into sales rather than jeonse.I was worried about the middle payment and balance when I was buying and selling, but at that time, I was able to put money in because I often saw the product.However, just because we bought and sold it again doesn’t solve everything. Rather, it has become more difficult to maintain a living by selling and selling? I used a lot of products here and there and made excessive loans to pay the balance. This will later become poison.We were forced to provide collateral loans for subordinated apartments.

What is subordinated apartment mortgage?

It is true that at first I was worried that this concept itself might be a loss. However, when I actually received the additional collateral limit, I felt that it was much more reasonable than what I used before. Subordinated collateral can be considered as one of the products that can receive money by receiving additional collateral loans for existing senior apartment mortgage loans or by increasing the amount in place of existing high interest rates. In other words, if you are a little tight due to existing debt like us now, you can solve it through subordinated apartment mortgage loans.

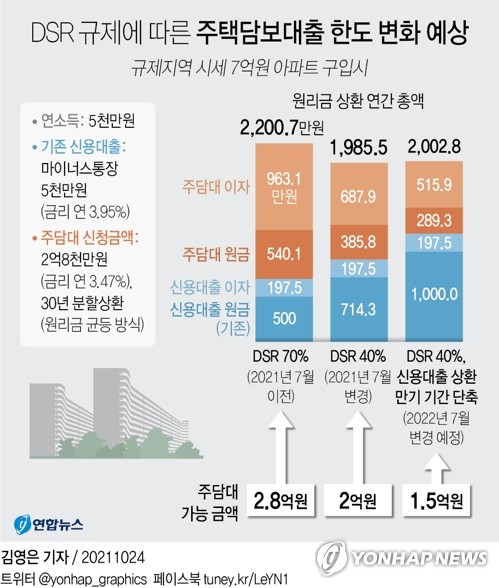

In order for commercial banks to solve it, they can receive a 70% limit as homeless people, but I think it’s a problem that needs to be looked at from a distance. If you take out and implement a mortgage loan, it may be difficult to try to borrow any more because it falls under the DSR regulations. It has become difficult to use additional funds by buying and selling houses under the sole name. So I trusted her later in her name. It’s really lively.By the way, do you want to get the number one mortgage? This doesn’t make sense.So it seemed difficult to maintain some products, so I got second place.

What are the benefits of a subordinated apartment mortgage?

There were quite a few good points about subordinated apartment loans.1. Compared to the LTV market price, it is possible from 80% to up to 99%.2. I heard that additional limits are possible even if the credit rating is grade 8. And not only office workers and businesses, but also unemployed people like housewives and freelancers.Of course, it is applied differently depending on the occupation, but I thought the conditions were very wide that it was possible. 3. If there is an existing high interest rate, you can replace it with a low interest rate.Additional collateral within the limit is also advantageous.

At first, my husband and I looked into other things before taking out subordinated apartment loans. Even so, I feel that the conditions are more complicated than I imagined and the limit is small.That’s why I first looked into finding a company that recognizes LTV highly.In the case of the items I received, there seems to be a slight difference depending on each region. It can be applied at fixed interest rates of up to 3 billion won, which can give room in that it can be received for up to 30 years I felt it.There may be a limit change depending on the house price.My husband and I were in a situation where the higher the limit, the more profitable it was, so we used to get points.Therefore, house prices were of paramount importance.I’m really glad to hear that you can try to borrow up to 95% of the treasure market. Most of them grasp the market price based on KB real estate, right? Therefore, please personally check the market price before going through the screening.The limit you can get depends on the market price!Q.Then what should I be careful about before proceeding? A.My husband and I were relieved because of this item, but that didn’t mean that we borrowed money with the imagination that we had to proceed unconditionally. Everyone will look into it before implementing it and receive counseling, but even if it is an item implemented by a financial company, it does not follow the regulations unconditionally. Except for commercial banks, the ratio of debt recognition varies slightly from financial company to financial company. It is recommended to compare the percentage of DSR by manufacturer. That’s the only way you can get a high limit!Q.What will happen to interest rates and repayment methods?1. On average, interest rates range from 3% to 15%.It seems that they go back and forth depending on the individual.2. The repayment method can be advanced such as equal repayment of principal and interest, temporary repayment of maturity, and one-year grace period, so why don’t you decide according to the current situation? 3. On average, the cleaning period is set aside for 5 years, and if you extend it, it will be advantageous up to 30 years, so there will definitely be plenty of room, right?Everyone, please accept the limit high when you are having a hard time like these days!Previous Image Next ImagePrevious Image Next ImagePrevious Image Next Image